U.S. Averages Comparison

This worksheet is only available for 1040 returns.

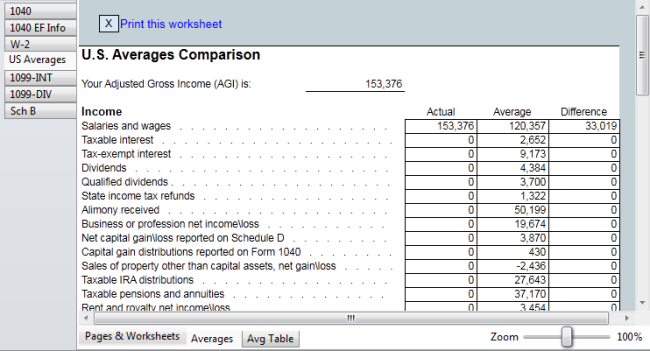

The U.S. Averages Comparison worksheet is a fully-calculated worksheet whereby the income and deductions in the tax return are compared to other returns with adjusted gross income within the same range. The comparative data is reported by the Statistics of Income Bulletin published by the IRS.

To use the U.S. Averages Comparison worksheet:

- Open your client's return.

- Click the Forms menu, expand the Planning/Analysis fly-out menu, and then select U.S. Averages Comparison.

U.S. Averages worksheet

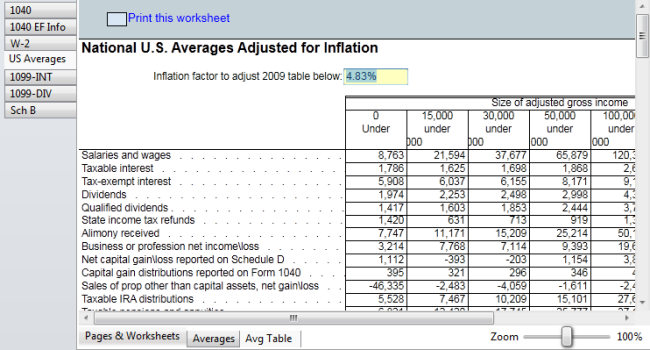

- To adjust for inflation, click the Avg Table worksheet.

U.S. Averages worksheet, Average Table (Adjusted for Inflation)

- Enter the appropriate inflation percentage.

See Also: